The decision of quality open source makers to offer their software at bargain basement prices even to enterprise customers who are used to pay prices many times more-pricing is the reason open source software is taking a long time to command respect in enterprise software.

I hate to be the messenger who brings the bad news to my open source brethren-

but their worst nightmare is not the actions of their proprietary competitors like Oracle, SAP, SAS, Microsoft ( they hate each other even more than open source )

nor the collective marketing tactics which are textbook like (but referred as Fear Uncertainty Doubt by those outside that golden quartet)- it is their own communities and their own cheap pricing.

It is community action which prevents them from offering their software by ridiculously low bargain basement prices. James Dixon, head geek and founder at Pentaho has a point when he says traditional metrics like revenue need o be adjusted for this impact in his article at http://jamesdixon.wordpress.com/2010/11/02/comparing-open-source-and-proprietary-software-markets/

But James, why offer software to enterprise customers at one tenth the next competitor- one reason is open source companies more often than not compete more with their free community version software than with big proprietary packages.

Communities including academics are used to free- hey how about paying say 1$ for each download.

There are two million R users- if say even 50 % of them paid 1 $ as a lifetime license fee- you could sponsor enough new packages than twenty years of Google Summer of Code does right now.

Secondly, this pricing can easily be adjusted by shifting the licensing to say free for businesses less than 2 people (even for the enhanced corporate software version not just the plain vanilla community software thus further increasing the spread of the plain vanilla versions)- for businesses from 10 to 20 people offer a six month trial rather than one month trial.

– but adjust the pricing to much more realistic levels compared to competing software. Make enterprise software pay a real value.

That’s the only way to earn respect. as well as a few dollars more.

As for SAS, it is time it started ridiculing Python now that it has accepted R.

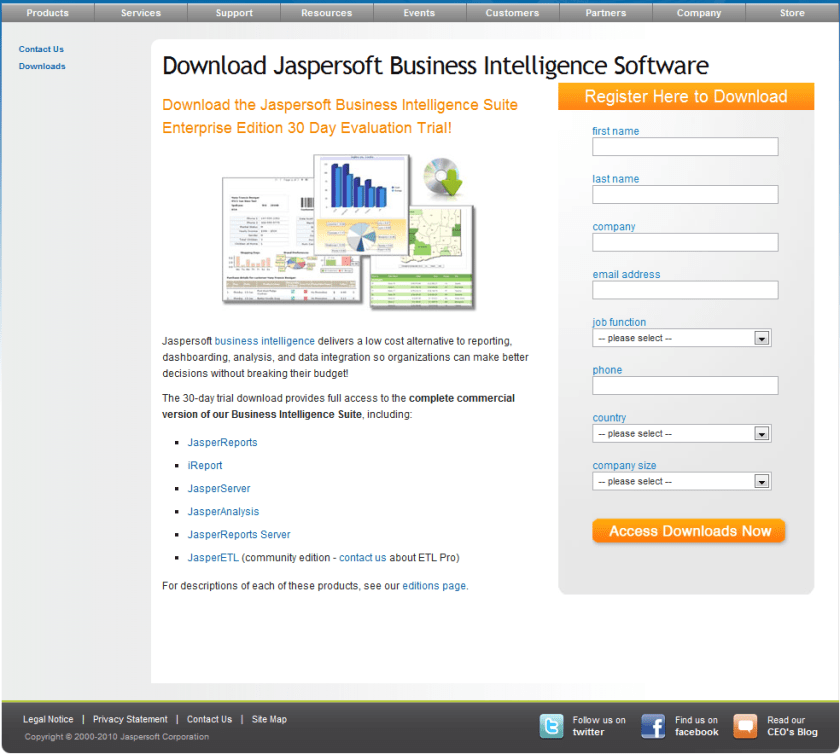

Dixon’s Pentaho and the Jaspersoft/ Revolution combo are nice _ I tested both Jasper and Pentaho thanks to these remarks this week 🙂 (see slides at http://www.jaspersoft.com/sites/default/files/downloads/events/Analytics%20-Jaspersoft-SEP2010.pdf or http://www.revolutionanalytics.com/news-events/free-webinars/2010/deploying-r/index.php )

Pentaho and Jasper do give good great graphics in BI (Graphical display in BI is not a SAS forte though probably I dont know how much they cross sell JMP to BI customers- probably too much JMP is another division syndrome there)

Related Articles

- SAS vs Open Source, ctd (revolutionanalytics.com)

- Reducing the Cost of Business Intelligence with Open Source (itexpertvoice.com)

- SAS vs Open Source (revolutionanalytics.com)

- Oracle doesn’t understand ‘community’ (thinq.co.uk)

- Who Really Pays for Open Source Software? (cmswire.com)

- More contributors leave OpenOffice.org for LibreOffice (infoworld.com)

- Microsoft Expresses Disdain/Hate for Open Source, Then Speaks on Behalf of Open Source (techrights.org)

- Oracle’s Ability To Shake Open Source Goes Beyond Java (ostatic.com)

- SAP Admits Wrong Doing (arnoldit.com)

- Google is not the enemy (zdnet.com)

- Surprise Winner in Oracle v. Google: Microsoft (pcworld.com)

Bruno Aziza is a recognized authority on Strategy Execution, Business Intelligence and Information Management. He is the co-author of best-selling book,

Bruno Aziza is a recognized authority on Strategy Execution, Business Intelligence and Information Management. He is the co-author of best-selling book,