Update from a very good data mining software company, KXEN –

- Longtime Chairman and founder Roger Haddad is retiring but would be a Board Member. See his interview with Decisionstats here https://decisionstats.wordpress.com/2009/01/05/interview-roger-haddad-founder-of-kxen-automated-modeling-software/ (note images were hidden due to migration from .com to .wordpress.com )

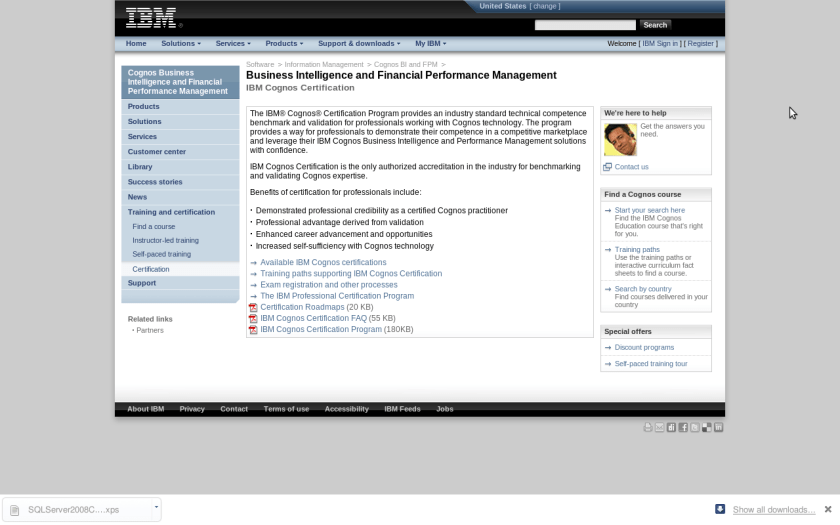

- New Members of Leadership are as-

John Ball John Ball

Chief Executive Officer

John Ball brings 20 years of experience in enterprise software, deep expertise in business intelligence and CRM applications, and a proven track record of success driving rapid growth at highly innovative companies.

Prior to joining KXEN, Mr. Ball served in several executive roles at salesforce.com, the leading provider of SaaS applications. Most recently, John served as VP & General Manager, Analytics and Reporting Products, where he spearheaded salesforce.com’s foray into CRM analytics and business intelligence. John also served as VP & General Manager, Service and Support Applications at salesforce.com, where he successfully grew the business to become the second largest and fastest growing product line at salesforce.com. Before salesforce.com, Ball was founder and CEO of Netonomy, the leading provider of customer self-service solutions for the telecommunications industry. Ball also held a number of executive roles at Business Objects, including General Manager, Web Products, where delivered to market the first 3 versions of WebIntelligence. Ball has a master’s degree in electrical engineering from Georgia Tech and a master’s degree in electric |

|

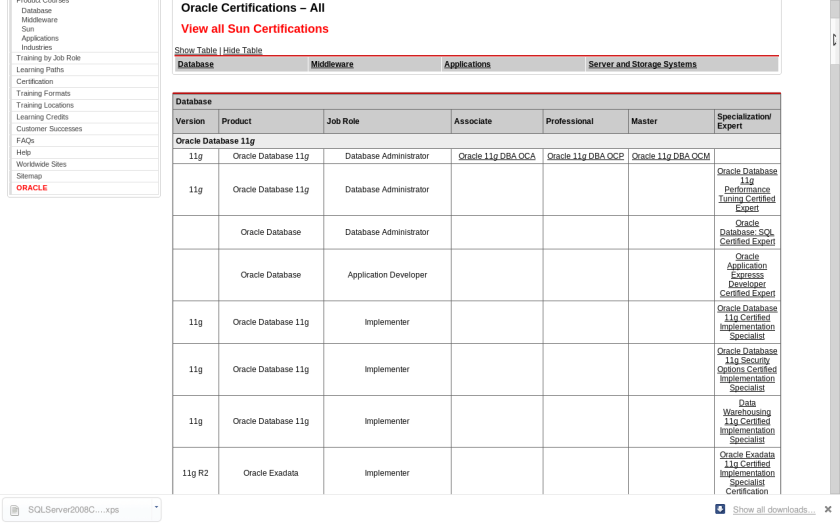

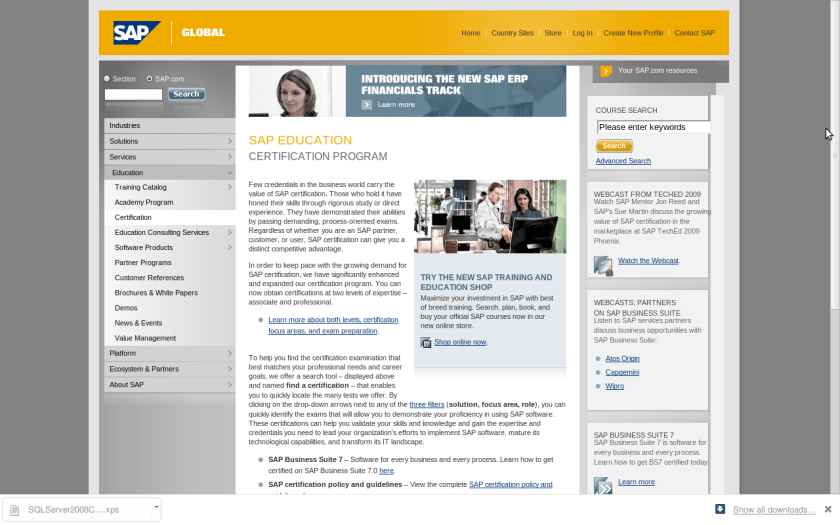

I hope John atleast helps build a KXEN Force.com application- there are only 2 data mining apps there on App Exchange. Also on the wish list more social media presence, a Web SaaS/Amazon API for KXEN, greater presence in American/Asian conferences, and a solution for SME’s (which cannot afford the premium pricing of the flagship solution. An alliance with bigger BI vendors like Oracle, SAP or IBM for selling the great social network analysis.

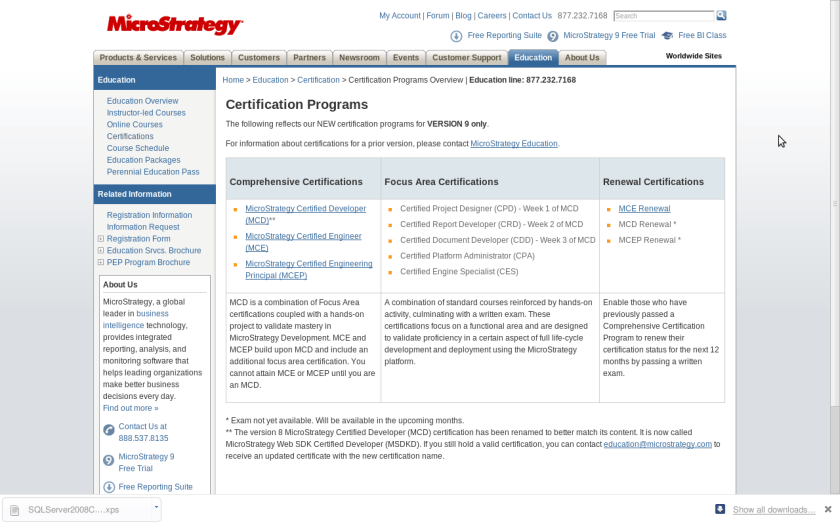

Bill Russell as Non Executive Chairman-

Bill Russell as Non-executive Chairman of the Board, effective July 16 2010. Russell has 30 years of operational experience in enterprise software, with a special focus on business intelligence, analytics, and databases.Russell held a number of senior-level positions in his more than 20 years at Hewlett-Packard, including Vice President and General Manager of the multi-billion dollar Enterprise Systems Group. He has served as Non-executive Chairman of the Board for Sylantro Systems Corporation, webMethods Inc., and Network Physics, Inc. and has served as a board director for Cognos Inc. In addition to KXEN, Russell currently serves on the boards of Saba, PROS Holdings Inc., Global 360, ParAccel Inc., and B.T. Mancini Company.

Xavier Haffreingue as senior vice president, worldwide professional services and solutions.

He has almost 20 years of international enterprise software experience gained in the CRM, BI, Web and database sectors. Haffreingue joins KXEN from software provider Axway where he was VP global support operations. Prior to Axway, he held various leadership roles in the software industry, including VP self service solutions at Comverse Technologies and VP professional services and support at Netonomy, where he successfully delivered multi-million dollar projects across Europe, Asia-Pacific and Africa. Before that he was with Business Objects and Sybase, where he ran support and services in southern Europe managing over 2,500 customers in more than 20 countries.

David Guercio as senior vice president, Americas field operations. Guercio brings to the role more than 25 years experience of building and managing high-achieving sales teams in the data mining, business intelligence and CRM markets. Guercio comes to KXEN from product lifecycle management vendor Centric Software, where he was EVP sales and client services. Prior to Centric, he was SVP worldwide sales and client services at Inxight Software, where he was also Chairman and CEO of the company’s Federal Systems Group, a subsidiary of Inxight that saw success in the US Federal Government intelligence market. The success in sales growth and penetration into the federal government led to the acquisition of Inxight by Business Objects in 2007, where Guercio then led the Inxight sales organization until Business Objects was acquired by SAP. Guercio was also a key member of the management team and a co-founder at Neovista, an early pioneer in data mining and predictive analytics. Additionally, he held the positions of director of sales and VP of professional services at Metaphor Computer Systems, one of the first data extraction solutions companies, which was acquired by IBM. During his career, Guercio also held executive positions at Resonate and SiGen.

3) Venture Capital funding to fund expansion-

It has closed $8 million in series D funding to further accelerate its growth and international expansion. The round was led by NextStage and included participation from existing investors XAnge Capital, Sofinnova Ventures, Saints Capital and Motorola Ventures.

This was done after John Ball had joined as CEO.

4) Continued kudos from analysts and customers for it’s technical excellence.

KXEN was named a leader in predictive analytics and data mining by Forrester Research (1) and was rated highest for commercial deployments of social network analytics by Frost & Sullivan (2)

Also it became an alliance partner of Accenture- which is also a prominent SAS partner as well.

In Database Optimization-

In KXEN V5.1, a new data manipulation module (ADM) is provided in conjunction with scoring to optimize database workloads and provide full in-database model deployment. Some leading data mining vendors are only now beginning to offer this kind of functionality, and then with only one or two selected databases, giving KXEN a more than five-year head start. Some other vendors are only offering generic SQL generation, not optimized for each database, and do not provide the wealth of possible outputs for their scoring equations: For example, real operational applications require not only to generate scores, but decision probabilities, error bars, individual input contributions – used to derive reasons of decision and more, which are available in KXEN in-database scoring modules.

Since 2005, KXEN has leveraged databases as the data manipulation engine for analytical dataset generation. In 2008, the ADM (Analytical Data Management) module delivered a major enhancement by providing a very easy to use data manipulation environment with unmatched productivity and efficiency. ADM works as a generator of optimized database-specific SQL code and comes with an integrated layer for the management of meta-data for analytics.

KXEN Modeling Factory- (similar to SAS’s recent product Rapid Predictive Modeler http://www.sas.com/resources/product-brief/rapid-predictive-modeler-brief.pdf and http://jtonedm.com/2010/09/02/first-look-rapid-predictive-modeler/)

KXEN Modeling Factory (KMF) has been designed to automate the development and maintenance of predictive analytics-intensive systems, especially systems that include large numbers of models, vast amounts of data or require frequent model refreshes. Information about each project and model is monitored and disseminated to ensure complete management and oversight and to facilitate continual improvement in business performance.

|

Main Functions

Schedule : creation of the Analytic Data Set (ADS), setup of how and when to score, setup of when and how to perform model retraining and refreshes …

Report: Monitormodel execution over time, Track changes in model quality over time, see how useful one variable is by considering its multiple instance in models …

Notification: Rather than having to wade through pages of event logs, KMF Department allows users to manage by exception through notifications. |

Other products from KXEN have been covered here before https://decisionstats.wordpress.com/tag/kxen/ , including Structural Risk Minimization- https://decisionstats.wordpress.com/2009/04/27/kxen-automated-regression-modeling/

Thats all for the KXEN update- all the best to the new management team and a splendid job done by Roger Haddad in creating what is France and Europe’s best known data mining company.

Note- Source – http://www.kxen.com

35.965000

-83.920000

John Ball

John Ball